Let's Get Started

Review the information below to help you get ready to apply for a home equity loan or line of credit.

-

it's easy to apply!

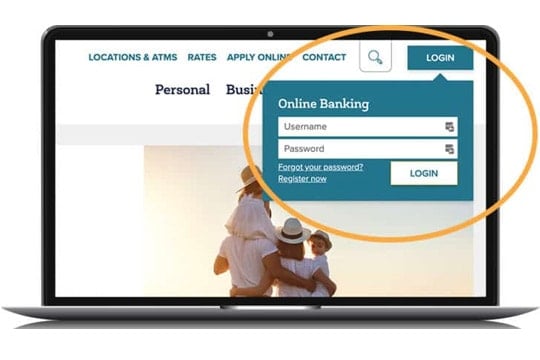

- Log into online banking.

- Select the Apply Now option in the turquoise menu bar.

- Select Apply for Loan or Sub Account from the dropdown menu.

- For your convenience, the application will open with pre-filled information from your account.

- Don’t have online banking? Click here to continue to a blank application.

- Your application will take a few minutes to complete.

-

what you'll need to provide

- Income verification (All borrowers/co-signers will need to provide their information.)

- If earning wages: current paystub & prior year W2

- If self-employed: rental or commission income, last two years of tax returns

- If receiving social security or pension: award letters

- Copies of most recent county, school, and village paid tax receipts

- Property information (Must be your primary residence or vacation residence, and must be located within New York State.)

- Estimated current market value of home

- Copy of homeowner’s insurance policy

- Signed Certification and Authorization form that Reliant will send you.

- Income verification (All borrowers/co-signers will need to provide their information.)

-

helpful information

- A member of our team will review your application, and we will be in touch with you within two business days.

- A home equity loan or home equity line of credit (HELOC) is secured by a mortgage on your home.

- A HELOC has a fixed rate for an intro period, and afterward will have a variable rate. Learn more about home equity loans and HELOCs.

Don’t have online banking or not a member yet?