Online Banking

Managing your money just got easier.

the features you need—the simplicity you want

At Reliant, we’re changing how you experience banking. Enjoy more control and convenience with a full suite of online tools.

Manage your money

With online banking, your accounts are always in reach.

- Check your account balances

- Find out if checks have cleared

- See your recent transactions

- View your e-statements1

- View e-notices, tax documents, and disclosures2

Do you have a Reliant Visa Platinum credit card? You can manage that online, too.

- Monitor activity

- Make payments

- View your e-statements

get email or text alerts

It’s reassuring to know that if any unusual activity takes place on your account, you can get notified by email or text.4 Simply choose the type of activity you want to watch for. For example, you can set up an alert for a low or high balance, or for unusual deposits or payments.

To get started, log into Online Banking, select the “Online Services” menu header, and select “Mobile Banking & Alerts.” You can also set text message alerts using the link in the right-hand column of the Account History screen.

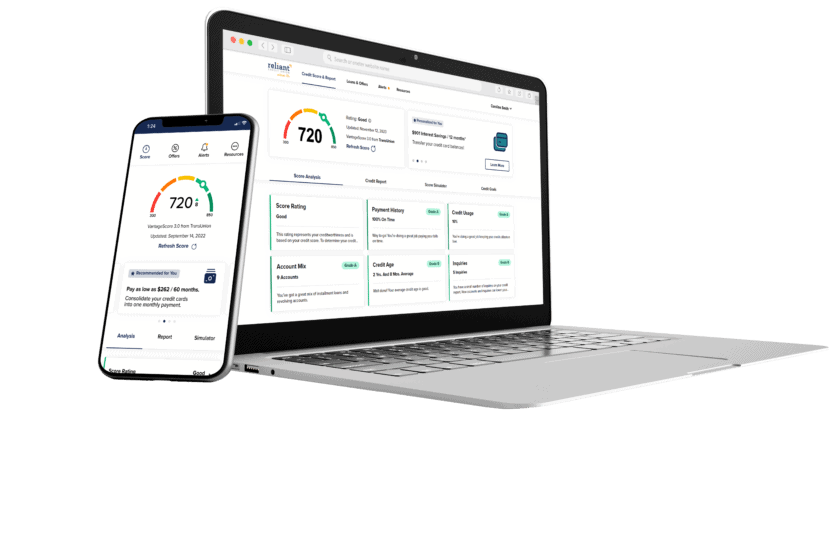

meet your financial wellness hub

Easily monitor your credit score, explore money-saving offers curated just for you, and set achievable financial goals—directly from your Reliant app.

To get started, login to online banking and select “Show Full Report” in the credit score banner located on the right of your account homepage.

make payments & transfers

Online banking makes it easy to pay bills and transfer funds.

- Enroll in bill payer, and you can move money between accounts at Reliant or elsewhere. Pay your friends, your bills or yourself!

- Zelle®, a fast, safe, and easy way to send money to family and friends using just a U.S. mobile number or email address.3 Learn more

transfer funds to family or close friends who are members

Transfer money directly to another Reliant member instantly within online banking or our mobile app. If you have close friends or family who are Reliant members and you need to send them money, all you need to know is their name and account number, and you can send them money in an instant.

Navigate to the “Transfer” menu in online banking or Reliant’s app to get started.

deposit your paycheck directly into your account

Direct deposit is safer than a “live” paycheck because it can’t get lost or stolen. You’ll be able to access your money as soon as it’s deposited, and you can decide how you want your funds to be distributed among your accounts.

When you’re signing up for direct deposit, you’ll need to provide the depositor with account and credit union information:

- Reliant’s routing #: 222 382 438

- For direct deposit into your checking account, use the 10-digit number that appears at the bottom of your Reliant checks.

- For direct deposit into your savings account, include your savings account number (1 to 6 digits).

For more information on how to have your social security or other federal benefit payments deposited directly into your Reliant account, visit GoDirect.org.

FAQs

If you have forgotten your password, click on the “Login” button in the header of our site and click on Forgot Your Password? A temporary password can be sent to any phone number registered with your account.

If you have a checking account with Reliant, you can enroll in bill pay, a free service that enables you to pay your bills online.

Always be sure to log in from a trusted device. If you have to log in from a public device, be sure to mark that device as such when prompted for a security code. Never share your login information with anyone. Install an anti-virus application on both your personal computer and your mobile device and keep it current. Visit our Fraud & ID Theft page to learn about other ways to protect your accounts and your identity from scammers.

enroll now

Disclosures

1 Member Account Billing Rights are disclosed on all member statements that are sent by U.S. Mail and on all PDF e-statements available for members in the online banking e-statements portal.

2 You must opt in to receive notices, disclosures, and tax documents electronically, within the e-statements & e-notices portal in online banking.

3 Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

4 By opting in for text message alerts, standard text messaging rates by your mobile phone/device provider may apply, and are the responsibility of the mobile phone/device owner.

5 To protect the privacy of account owners, no account owner can conduct any other type of financial transaction on an account for which he/she does not have the User ID and password.

6 To access your account using Mobile Banking, you must first enroll your account in Online Banking. Once enrolled, you will use the same Username and Password to access your account through both online and mobile banking.